What's The Best S&P500 ETF? SPY vs VOO vs IVV

According to the latest stats, 92% of professional fund managers are unable to beat the market.

In this case, "the market" refers to the S&P500 — an index of 500 large publicly traded companies in the US. This means that even most professional stock pickers are unable to get higher returns than this popular index.

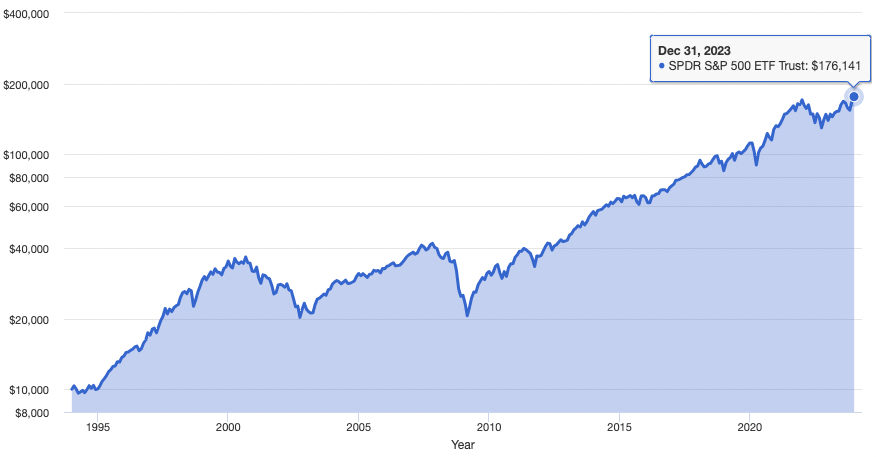

This is no easy feat, because the S&P500 has actually returned 8–10% per year on average over the past few decades. Of course, this included various periods of volatility where it may have dropped 40–50% or more before eventually moving higher.

The chart below shows that if you invested $10,000 in the S&P500 in the year 1990, it would have grown into $176,141 today:

Source: portfoliovisualizer.com

When this kind of return compounds over time, it can build up to substantial wealth if you simply buy and hold for years and decades.

For this reason, many legendary investors like Warren Buffett recommend that most people don't even try to pick individual stocks. Instead, they should put their money into an index fund that tracks the S&P500.

This is like buying a "basket" of the 500 companies in the S&P500, as if you owned shares in all of them.

It is simplest to do this by buying an exchange-traded fund (ETF) that tracks the S&P500 index. These ETFs are financial products that hold shares of all the companies in the index, but the ETF shares are traded just like stocks.

They also pay you a dividend every three months, which can be reinvested to buy more shares of the ETF. This increases the compounding effect of your investment as both the price of the ETF and the number of shares you own are growing over time.

That being said, the ETF and index fund space is crowded and there are several popular options to choose from.

This article looks at the three most popular S&P500 ETFs — SPY, VOO, and IVV — and at the end tells you which one you should choose.

SPY: SPDR S&P 500 Trust ETF

- Expense ratio: 0.09%

- Dividend yield: 1.41%

- Assets under management: $489.6 billion

The SPDR S&P500 Trust ETF (SPY) is the world's biggest exchange-traded fund, with a whopping $260 billion invested in the fund at the time of this writing.

SPY was launched in 1993, which makes it the oldest ETF on the US market. It has returned an impressive 9.9% per year since inception.

Despite having a slightly higher expense ratio than VOO and IVV, it is actually preferred by active traders because of its high trading volume. 78 million shares of SPY are traded every day, compared to under 5 million per day for VOO and IVV.

This means that it is easy to buy and sell large amounts of SPY without it moving the price of the ETF much. So people can get in and out of their trades quickly without much extra cost in the form of slippage.

In addition, options for SPY are highly liquid and have very low bid-ask spreads, which makes it the preferred S&P500 ETF for options traders.

VOO: Vanguard S&P500 ETF

- Expense ratio: 0.03%

- Dividend yield: 1.47%

- Assets under management: $370 billion

The Vanguard S&P500 ETF (VOO) is offered by Vanguard, a company founded by a legendary investor called Jack Bogle. He pioneered passive investing via index funds, which dramatically changed the investing landscape.

VOO has a very low expense ratio of 0.03% and has returned an average of 13.87% since inception in 2010.

IVV: iShares Core S&P500 ETF

- Expense ratio: 0.03%

- Dividend yield: 1.46%

- Assets under management: $397 billion

The iShares Core S&P500 ETF (IVV) is offered by iShares, a family of ETFs managed by BlackRock. This company is the world's biggest asset manager with about 8.6 trillion under management.

IVV has returned an average of 6.69% since its inception in 2001. The reason this is lower than both SPY and VOO is because the returns from 2000–2009 were very poor with two massive bear markets.

All 3 ETFs have very similar returns

The table below shows the 1-, 3-, and 5-year returns for the three ETFs.

| SPY | VOO | IVV | |

| 1-year | 3.70% | 3.75% | 3.75% |

| 3-year | 14.90% | 15.00% | 14.99% |

| 5-year | 10.80% | 10.89% | 10.87% |

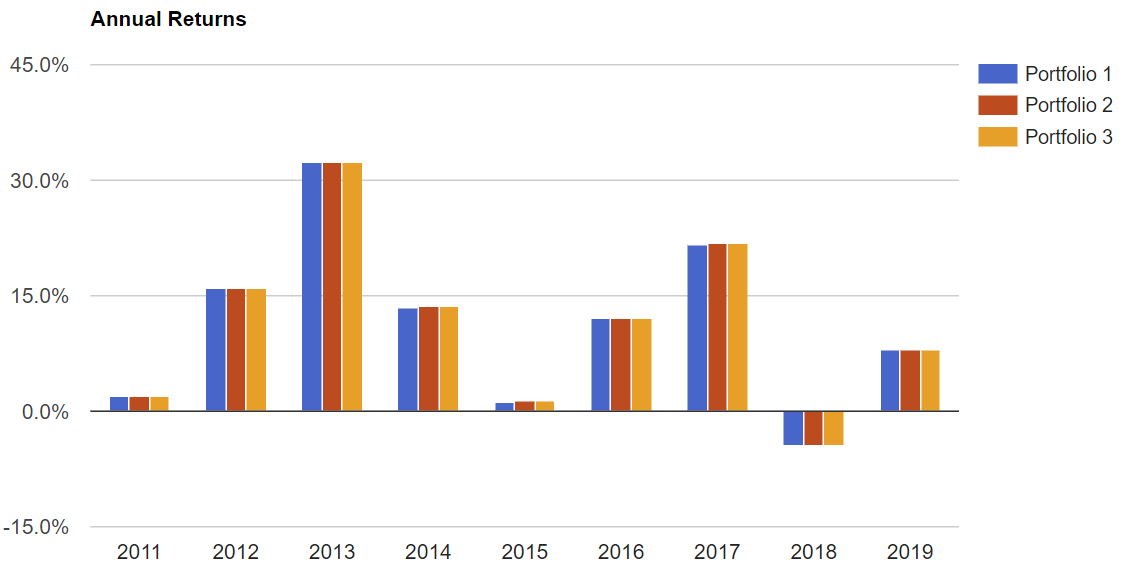

As you can see, these ETFs all have almost the exact same returns. But VOO and IVV should have a 0.06% higher annual growth rate compared to SPY because of the lower expense ratio.

The chart below compares the annual returns for each of the ETFs since 2011 (blue is SPY, red is VOO, yellow is IVV).

As expected, the returns are pretty much identical.

Source: portfoliovisualizer.com

Which S&P500 ETF to choose?

As you can see from the stats and charts, there really is no big difference between the returns for these S&P500 ETFs.

The most important difference is the expense ratio, since VOO and IVV are slightly cheaper than SPY and should have a 0.06% higher compound annual growth rate. This can make a small difference in returns if you buy and hold for several decades.

That being said, you may want to check with your broker and see if they offer any of these ETFs without commission charges.

If that is the case, then the commission-free ETF will likely be your best choice as the money you save on commissions will far outweigh the savings on the expense ratio.

If you are actively trading the ETF or trading options on it, then SPY will be best as it has the highest volume, tightest bid-ask spreads and the least slippage.

Here's a simple summary of which one to choose:

- If you are an active trader or options trader, choose SPY.

- If you plan to buy and hold, choose VOO or IVV.

- If your broker offers any of them commission-free, then choose that one.

I personally chose VOO as my go-to S&P500 ETF since I like Vanguard as a company and am proud to do business with them. But you would get the exact same returns with IVV.