YoY (Year-Over-Year)

What does YoY Mean?

YoY stands for year-over-year, which is a way to compare the financial results of a time period compared to the same period a year earlier. YoY is often used by investors to evaluate whether a stock's financials are getting better or worse.

If a company's revenue and earnings are growing year-over-year, then that indicates the company is growing. If these numbers are declining year-over-year, that suggests the company is shrinking.

YoY is sometimes written as Y/Y.

Examples

A company had $110 million in revenue in 2018, compared to $100 million in 2017. In other words, revenue increased by $10 million compared to the previous year, which amounts to a 10% YoY revenue growth.

Another company had $50 million in earnings in the fourth quarter of 2018, but they had $100 million in earnings in the fourth quarter of 2017. This means that earnings decreased by 50% year-over-year.

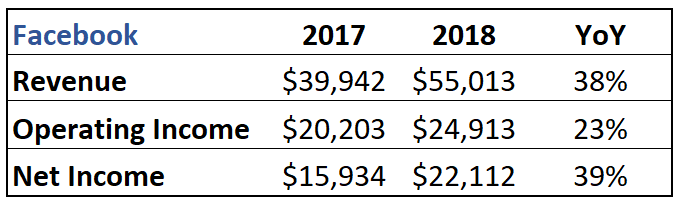

Here's an example of how Facebook's financial performance changed YoY in 2018:

It's also common to compare quarterly financials on a YoY basis – as in, whether financials improved or worsened compared to the same quarter a year earlier.

For example, Tesla's (TSLA) revenue increased from $7,226 million in Q4 2018 to $7,384 million in Q4 2019. That is YoY growth of 2.1%.

Looking at a quarter's financials compared to the same quarter a year earlier is very useful because it helps eliminate fluctuations in the numbers due to seasonality.

If you were to compare a retailer's Q3 and Q4 sales, you might think that the company grew a lot in Q4. But this quarter includes the holidays, which tend to lead to a lot of sales each year.

Because of this, it makes much more sense to compare quarterly financials on a YoY basis. It gives a more accurate view of whether the numbers are growing or declining.

How to calculate: formula

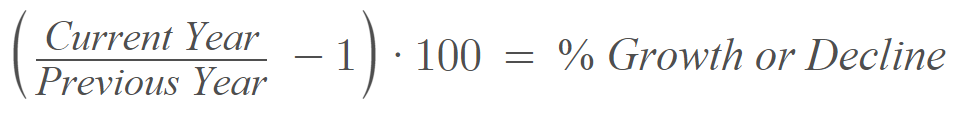

The formula to calculate YoY growth or decline is simple. You divide the new number by the old number to find the ratio. To convert to percentages, you can subtract by 1 and then multiply by 100.

Here is the formula:

QoQ stands for quarter-over-quarter

QoQ is just like YoY, except it stands for quarter-over-quarter. It measures the sequential growth/decline in three months, compared to the previous three months.

For example, if a company has 10 million paying subscribers at the end of Q3, but 12 million at the end of Q4, that indicates QoQ growth of 20%.

Why YoY is important

Looking at year-over-year comparisons for companies is one of the simplest ways to tell whether they are growing or declining.

It is generally smarter to invest in stocks that are growing because they tend to increase their revenue and earnings over time, causing the stock prices to rise.

On the other hand, companies that have declining revenue and earnings tend to see significant reductions in their stock prices.