Operating Expenditure (OpEx)

Operating expenditure, or OpEx, is a category of costs accounting for the day-to-day expenses of a business.

OpEx is calculated by adding up these expenses, like so:

OpEx = rent + utilities + sales and marketing + insurance + administrative + research and development

Note that depending on the company and industry, this list may not be exhaustive.

Companies split costs into categories in order to understand where money is being spent, with OpEx providing critical insights into how much it costs to run the business.

Operating expenditure may also be called operating expenses or operational expenditures.

Below is a complete guide to OpEx, including what it is, how to calculate it, and how it compares to capital expenditures (CapEx).

What is OpEx?

Running a business costs money. These costs, or expenditures, are split into different categories depending on how they contribute to the business.

These categories include operating expenditure (OpEx), the cost of goods sold (COGS), non-operating expenses (non-OpEx), and capital expenditure (CapEx).

OpEx is the cost of “keeping the lights on” in a company's day-to-day business operations.

The costs included are:

- Rent

- Utilities

- Sales and marketing

- Insurance

- Management and administrative

- Research and development

- Others

OpEx helps illuminate how much is being spent to run the business, excluding the costs linked to producing goods and services, which are accounted for via the cost of goods sold (COGS).

As an example, managers' salaries at a car factory would be included in OpEx, while the cost of the workers' wages on the assembly line would be part of COGS.

OpEx costs, along with COGS and non-OpEx, are shown on the income statement. As such, they are deducted from revenue to arrive at profit.

OpEx is generally listed right above operating income, usually with a further breakdown of expenses below it, such as selling, general, and administrative (SG&A); research and development (R&D); and other operating expenses.

Additionally, OpEx is often used to look at the operating ratio, which provides further insights into how efficiently a company is being managed. This ratio takes into account OpEx plus COGS, revealing the proportion of net sales used to pay for the total operating expenses.

SummaryOperating expenses (OpEx) account for the costs associated with running the day-to-day business, such as rent, utilities, sales and marketing, insurance, administrative costs, and research and development costs.

How is OpEx calculated?

OpEx is calculated by combining the indirect costs of running the day-to-day business:

OpEx = rent + utilities + sales and marketing + insurance + administrative + research and development

Note that this is not a complete list, as different companies and industries will have different expenditures. Therefore, on the income statement, it is shown as:

OpEx = selling, general, and administrative + research and development + other

You can access income statements on the SEC website, a company's investor relations page, or by using data websites like Stock Analysis.

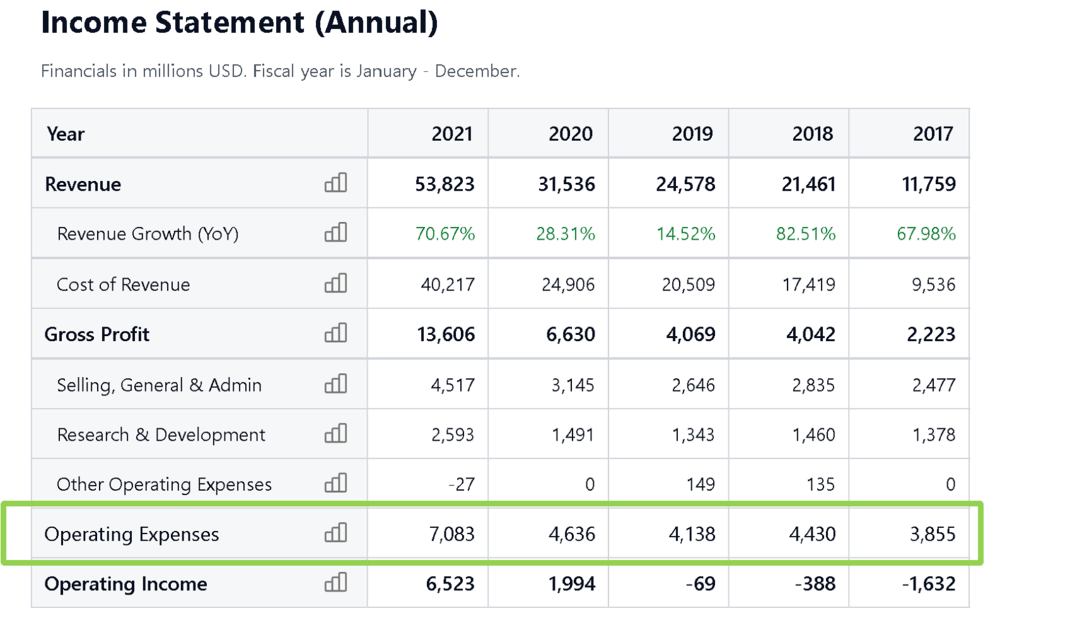

Here is a sample income statement for Tesla (TSLA) with OpEx highlighted:

Source: Tesla's Income Statement

SummaryOpEx is calculated by adding up the costs of running the business or by adding up the categories of those costs — SG&A, R&D, and other operating expenses. You can find OpEx on a company's income statement, published in several places online.

What is not included in OpEx?

Costs that are excluded from OpEx include:

- Cost of goods sold (COGS): The COGS calculation covers the costs that go into producing goods, including manufacturing costs, raw materials, workers' wages, etc.

- Non-operating expenses (non-OpEx): These costs can include interest charges, costs from borrowing, or losses on the disposal of assets.

- Capital expenditure (CapEx): This is the expenditure associated with buying longer-term investments, so the costs of maintaining, acquiring, or upgrading physical assets such as plants, equipment, property, buildings, etc.

Non-OpEx expenses are separated to show how well a company is running its business, rather than how well it is managing its capital structure. This is listed on the income statement.

CapEx costs are not seen as expenses on the income statement and are instead capitalized on the company's balance sheet. This is because CapEx expenses are seen as investments made back into the business.

It is only in subsequent years that CapEx costs directly affect income, once they become depreciation costs that are spread over the lifetime of the asset. For example, a newly built plant or technology upgrades for a car manufacturer would be considered CapEx.

After the appropriate expenses are deducted, you arrive at net profit.

SummaryCOGS, non-OpEx, and CapEx expenses are all separate from OpEx. Like OpEx, COGS and non-OpEx expenses are listed on the income statement, while CapEx is listed on the balance sheet.

Why is OpEx useful?

OpEx is important to both a company and investors, as it provides insights into how overhead costs are affecting profitability.

Companies can increase profits by either increasing revenue or decreasing costs.

OpEx is the total of the indirect costs of running the business. As such, it provides key insights into the overheads required to run the business.

If these expenses become too large in proportion to revenue, then cost-cutting measures may be needed. For example, bloated SG&A costs can often show poor planning by management.

However, it's important to remember that if OpEx is cut too far, this may end up hurting future revenue because the quality of the products or sales figures may also decrease.

OpEx is also useful when making comparisons year-over-year or to competitors, as it can reveal under or overspending on overhead costs.

SummaryOpEx is useful because it provides critical insights into core business spending. If the expenses become too large in relation to revenue, costs may need to be reduced.

What are the limitations of OpEx?

OpEx, while very useful, doesn't provide insights into how the company is preparing for the future, such as putting money toward maintenance or investments.

For this reason, it's important to analyze R&D trends to see if those investments are translating to significant product sales.

It's promising to look at an income statement and see that a company is on top of its day-to-day indirect costs, but it's also important to be able to determine whether a company is setting itself up for future success in terms of what it's investing back into the business.

So in order to get a full picture of how bright a company's future looks, you'd want to look at both OpEx and CapEx.

In short, OpEx provides an excellent overview of the way the business is being run, but it can't shed any light on how it will look going forward.

If a company fails to invest in maintaining or expanding its operations, it may eventually become less efficient and less competitive. Since investors are buying into the expectation of future earnings, it's important to consider this aspect of a company's strategy.

The other limitation of OpEx is that while it gives the full account of day-to-day indirect costs, it doesn't include the direct costs of producing goods — COGS — or provide insights into how well the company is structuring its capital — non-OpEx.

SummaryOpEx is a critical and highly useful metric. However, it should be considered alongside CapEx and other expenses to provide a full picture of the business's present operations and future strategy.

OpEx vs CapEx: how do they compare?

The main differences between OpEx and CapEx are what they account for and when.

CapEx is for tangible assets that will be used for longer than a year, while OpEx is the money spent on normal operations during a specific accounting period.

CapEx is focused on the future, while OpEx is about the here and now.

CapEx costs are considered investments, and, as such, are capitalized and depreciated over the asset's useful lifetime instead of expensed during the year they were purchased.

OpEx, on the other hand, accounts for the costs of running the business during a specific period.

Companies need to consider CapEx as a part of keeping OpEx healthy during future years, as investing in maintaining or expanding operations is key. Otherwise, OpEx could increase due to outdated or broken machinery, lack of investment in technology, etc.

CapEx items can be capitalized, meaning the costs show up on the balance sheet as assets in the year purchased. But from the following year onwards, the cost will be spread across the lifespan of the asset, via depreciation, on the income statement.

As an example, an oil company like BP plc (BP) would list management salaries and advertising costs in OpEx but would capitalize their new offshore platform via CapEx.

The cost of the new platform would be divided over the number of years of its useful life, and shown on the income statement as a depreciation cost.

This is a more reasonable way to account for expensive one-off costs, especially in capital-intensive companies like oil and gas or manufacturing.

Otherwise, these companies would have massive variations in profits every time they bought a new asset, making understanding their performance quite confusing.

SummaryOpEx and CapEx account for different expenses during different time periods. OpEx is about the day-to-day spending of the business during an accounting period, while CapEx is about expenses considered investments in the future of the business.

Operating ratio: formula and example

OpEx is often used to calculate the operating ratio, which indicates how efficiently a company is being managed by evaluating what proportion of net sales are used to run the business.

To calculate the operating ratio, you need both OpEx and COGS.

Here is the formula:

Operating ratio = (OpEx + COGS = total OpEx) / net sales

You can then multiply the result by 100 to get the ratio as a percentage.

Companies and investors generally look for a reducing or steady ratio, since this indicates the company is doing a good job in reducing costs or keeping them steady compared to sales.

However, if costs were reduced too much, this may indicate the company has been too extreme in cost-cutting in order to make profits look better, which may have effects elsewhere.

This is a balance, and it's important to analyze more aspects of the business to assess how it's really functioning and ensure it's being run in a healthy, sustainable way.

Example calculation

Below is a sample calculation for a company with an OpEx of USD $2 million in year one and $4 million in year two. It has the same COGS for both years — $3 million — and net sales go from $8 million in year one to $10 million in year two.

| Year | Calculation | Result x 100 | Operating ratio |

| 1 | (2 +3) / 8 | = 0.625 x 100 | = 62.5% |

| 2 | (4 +3) / 10 | = 0.700 x 100 | = 70.0% |

So although the company's net sales are higher in year two, the company is spending a larger portion of that revenue on OpEx.

This could mean they've increased management salaries or spent more on sales and marketing, but it hasn't yet paid off.

Further investigation into other numbers and ratios would be necessary to find out more.

SummaryThe operating ratio is a useful way to see how well a company is being managed year-to-year. It is calculated by determining what proportion of sales revenue is used to fund the business.

The takeaway

Operating expenditure, or OpEx, provides an overview of the indirect costs required for the day-to-day running of the business, also known as the costs of “keeping the lights on.”

OpEx is its own line item on the income statement, alongside the costs related to producing the goods — COGS. These two numbers make up the total costs of running the business.

OpEx and COGS can be used to gauge how efficiently a business is being run. They can also be used to calculate and assess operating ratio.

Importantly, OpEx does not cover the capital costs of the business, which are non-OpEx.

Additionally, OpEx is focused on spending during a specific accounting period and differs from CapEx, which accounts for the costs incurred to maintain or grow the business later on.

As an investor, it's important to look at OpEx to understand the efficiency of the business, especially when compared to past performance or peers, as well as CapEx, to ensure the company has a bright future ahead of it — which is what you're buying into as an investor.