Cash Flow Statement

The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time.

It tells you how cash moves in and out of a company's accounts via three main channels: operating, investing, and financing activities.

A cash flow statement is one of three core financial statements released by publicly traded companies when they report earnings quarterly and annually. The other two are called the income statement and balance sheet.

The income statement is the main statement for profits and losses. However, it can be misleading because it reports "accounting earnings," which are affected by all sorts of non-cash items.

However, the cash flow statement only shows actual cash flowing in and out of the company.

This is crucial because cash is the lifeblood of a business. It determines whether inventory gets bought and salaries paid. Without a steady stream of cash, most companies go out of business very quickly.

If you want to be an informed investor, then you need to be familiar with the cash flow statement. It contains useful information that can help you determine if an investment is good or bad.

The cash flow statement has three parts

The cash flow statement tells you a lot about where the cash on the balance sheet comes from. It also tells you what the company spends its cash on.

By looking at the statement, you can see whether the company has enough cash flowing in to fund its operations, pay its debts, and return money to shareholders via dividends or stock buybacks.

The cash flow statement has three main parts:

- Cash from operating activities: Often termed operating cash flow, this is the amount of cash left over after all the cash income and cash expenses for the core operations are received and paid for.

- Cash from investing activities: This part lists cash used to buy and sell investments and long-term assets. It includes capital expenditures.

- Cash from financing activities: This part shows cash flows to and from owners, investors, and creditors (like banks). It includes changes in debt and equity, as well as dividends and share buybacks.

The sum of the cash flows from the three categories is termed net cash flow, often listed as "increase/decrease in cash and equivalents." This number will be equal to the changes in cash and cash equivalents on the balance sheet for the same period.

Why cash is different from income

It's important to understand that revenue and net income (earnings) are not the same as cash gained by the business.

The income statement uses the accrual basis of accounting, which recognizes revenue and expenses when the product or service is provided, not necessarily when it is paid in cash.

For example, if a customer buys a product on credit, the amount is shown as revenue on the income statement. But it won't be included in the cash flows until the customer actually pays for the product.

Also, a writedown of the goodwill of an asset can cause a massive reduction in accounting earnings even if it technically doesn't cost the company any cash.

It is simply due to an accounting process that reduces the value of the asset on the balance sheet.

Accounting earnings are also affected by stock-based compensation. When employees get paid in stock options, their value is subtracted from earnings.

All of these things can affect accounting earnings even though they had zero effect on the company's cash position at the time.

Because of this, it is crucial to look at the cash flow statement along with the income statement to get a clearer picture of a company's financial situation.

Example of a cash flow statement from a real company

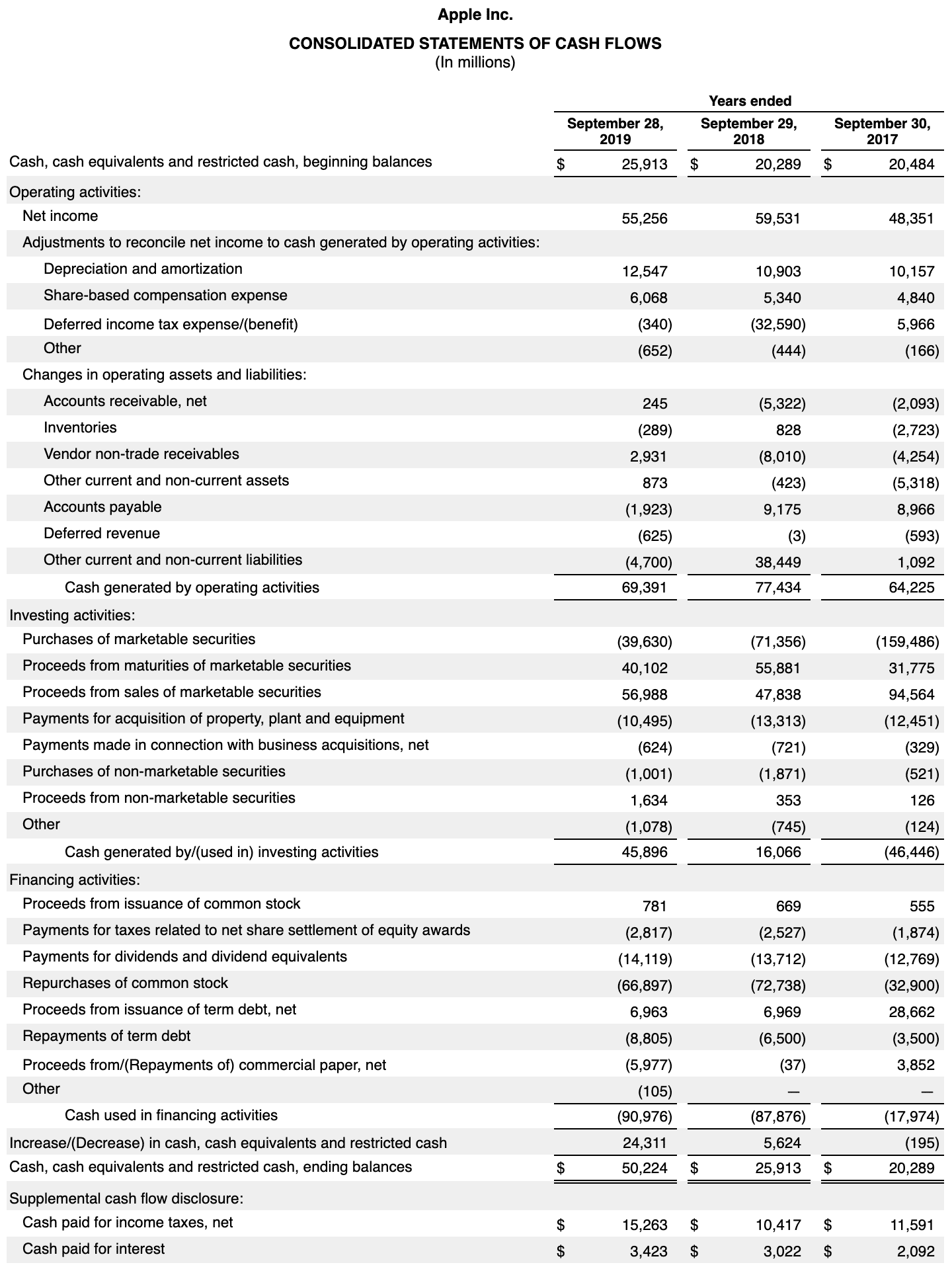

Here is Apple's cash flow statement from its 2019 annual report.

When reading it, keep in mind that cash flowing in is shown as a positive number, while cash flowing out is a negative number (shown in parentheses).

The operating cash flow, listed as "cash generated by operating activities," shows that Apple generates a lot of cash from its main business ($69 billion in 2019 alone).

You can also see that Apple spent a lot of money on share buybacks (repurchases of common stock) and dividend payments. Apple has rewarded its shareholders well in the past few years.

They've also invested a lot into the business, shown as "Payments for acquisition of property, plant, and equipment." This is Apple's capital expenditures (CapEx).

Common components of a cash flow statement

Below are explanations of the most common components of cash flow statements for publicly traded companies.

Cash flow from operations

Cash flow from operations is the amount of cash generated from the normal functions of the business.

If the number is positive, that means the core business is taking in more cash than it spends. It also implies that the company is inherently profitable.

On the other hand, negative operating cash flow is bad. It implies that the company is not generating enough cash to sustain itself, let alone having cash left over to pay its debts.

Operating cash flow is usually calculated by starting with the net income from the income statement, then adding and subtracting non-cash items.

These non-cash items can include:

- Stock-based compensation expenses

- Depreciation and amortization

- Changes in accounts payable

- Changes in accounts receivable

- Goodwill and asset impairments

These non-cash items have been accounted for on the company's income statement and balance sheet. But they are removed when calculating the operating cash flow.

When you remove all non-cash items from the net income, you get the operating cash flow. It is the cash generated after all the cash income and cash expenses of the core business.

Calculating cash flow from operations by starting with net income and then adding/subtracting non-cash items is called the "indirect method." This is how it is calculated for most publicly-traded companies.

Another method called the "direct method" simply adds up all the cash changes instead of starting with net income and calculating from there.

Cash flow from investing

Cash flow from investing shows cash inflows and outflows from buying and selling investments and long-term assets.

The most important item here is capital expenditures or CapEx. It is cash spent on buying long-term assets that will be used to run the business, such as manufacturing equipment, real estate, and others.

Capital expenditures are usually listed as "purchases of property, plants, and equipment" on the cash flow statement.

Importantly, capital expenditures are accounted for immediately on the cash flow statement. But the expenses are spread out over several years on the income statement.

The investing cash flow section also shows the cash flows from other investing activities. This includes purchases and sales of marketable securities.

Marketable securities are things like short-term bonds and money market funds that the company buys to gain interest on its cash reserves. When the company needs the cash, it sells the marketable securities.

Cash flow from financing

Cash flow from financing shows the cash flows to and from those who fund the company: its owners (investors) and creditors (like banks).

When the company raises cash by issuing shares or by getting a loan from the bank, it is shown in the financing cash flow section. Conversely, when a company buys back shares or pays its debts, it is also shown in this section.

The financing cash flow also shows money returned to shareholders via dividends.

If financing cash flow is a positive number, it means that the company has been raising cash via debt or equity. If it is a negative number, it means that the company is returning money to investors or paying back debts.

Net cash flow

When you add up the operating, investing, and financing cash flow numbers, you get the net cash flow.

Net cash flow is the change in cash and cash equivalents on the company's balance sheet during the accounting period. It is often listed as "increase/decrease in cash and cash equivalents" on the cash flow statement.

Negative net cash flow is not necessarily a bad thing. For example, it could be negative if the company bought a lot of marketable securities to store its cash.

Net cash flow should not be confused with free cash flow, which is much more important.

How to calculate free cash flow

Free cash flow is one of the most important financial numbers for investors.

It tells you how much cash a company has left after spending on everything required to maintain and grow the business. Many consider it to be an even better measure of profitability than net income.

Companies are not required to show free cash flow when they report earnings, but many companies still do it.

You can easily calculate free cash flow by subtracting the capital expenditures from the operating cash flow. The capital expenditures are usually listed as "purchases of property, plant, and equipment" or something similar.

If free cash flow is positive, that means the company is making enough money to maintain and grow the business, as well as return money to shareholders and creditors.

Stocks that have strong and growing free cash flows tend to be great long-term investments.

More things you can learn from a cash flow statement

You can learn many important facts about a company's financials from looking at its cash flow statement.

For example, you can learn whether the company is generating enough cash from operations to cover its debts and other liabilities.

You can also learn whether it is generating enough cash to not only cover its liabilities but also return money to shareholders via dividends or share buybacks.

It's also possible to see the sustainability of dividends by looking at how much the company is paying in dividends relative to its free cash flow.

If the company has much higher free cash flows than it pays in dividends, then the company is likely to raise its dividend payments in the near future.