7 Platforms With Alternative Investments for Non-Accredited Investors

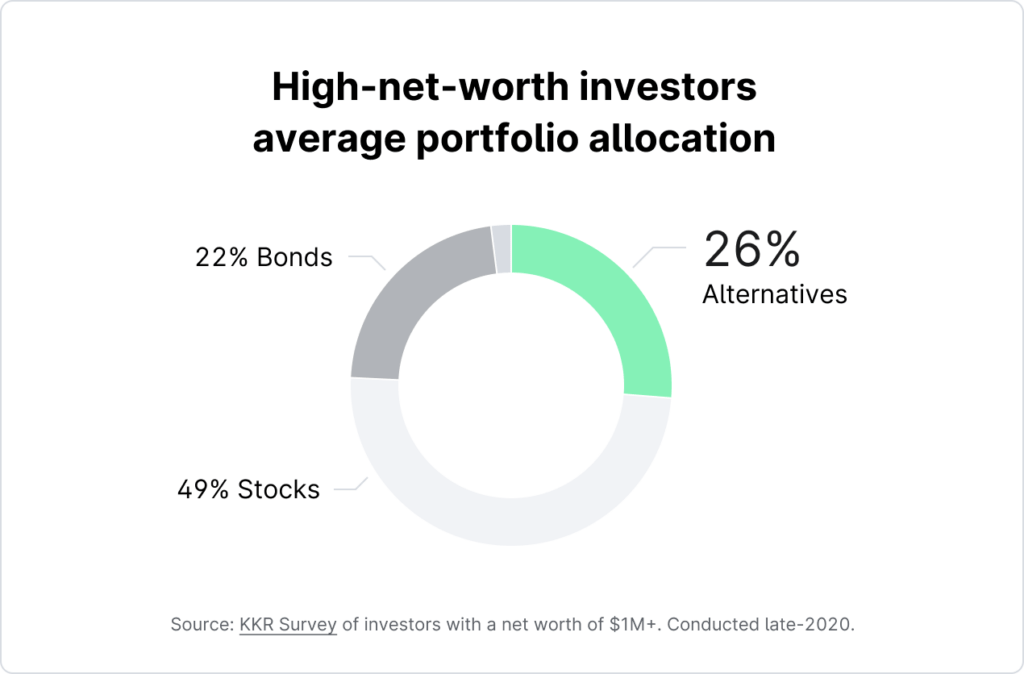

In the last few years, a major shift toward alternative assets has begun.

Alternatives are attractive because they offer potentially higher returns, a possible hedge against inflation, and diversification outside of traditional markets.

However, because alternatives are relatively new offerings, the SEC has deemed many of them risky and not suitable for all investors.

Only “accredited investors” are eligible to invest in certain alternative assets.

Accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

If you don't qualify as an accredited investor, you may feel like your options for alternative investing are limited, though that's not entirely the case.

In fact, a handful of the best alternative investing platforms have launched offerings that give non-accredited investors opportunities to access their assets.

That means you can invest in real estate, art, venture capital funds, private debt, and more. Here's how.

Summary view: best platforms for non-accredited investors

- Best overall: Yieldstreet

- Best for vacation rental properties: Arrived

- Best for venture capital: Fundrise

- Best for high-end art: Masterworks

- Best for cryptocurrencies, collectibles, and traditional markets: Public

- Best for private REITs: RealtyMogul

- Best for peer-to-peer lending: Prosper

Keep reading for more detailed breakdowns of each platform listed above.

Disclaimer: Ratings are my opinion. Actual results may vary, and past performance does not guarantee future results. All investors should do their own due diligence.

1. Yieldstreet: best overall

- Overall rating:

- Asset(s): Real estate, art, private credit, cryptocurrencies, venture capital, and more

- Minimum investment: $10,000

Yieldstreet is the top platform for alternative investing.

On Yieldstreet, you can access 11 alternative asset classes, all under one login.

Plus, each individual investment is vetted by a team of experts. This breadth of highly curated investment options is why more than 450,000 investors have invested more than $3.9 billion on Yieldstreet.

Source: Yieldstreet

While the bulk of the listings on Yieldstreet are only available to accredited investors, my favorite offering of theirs — the Yieldstreet Alternative Income Fund — is available to all investors.

The fund invests in real estate, private credit, legal finance, art, structured notes, and more to generate a balance of income and price appreciation.

It's also the easiest way to diversify your portfolio across a range of alternative investments, and is why Yieldstreet ranks #1 on this list.

The biggest drawback to the Alternative Income Fund is that it has a minimum investment of $10,000.

Personally, I don't want alternative assets to make up more than 25% of my portfolio, so this would prohibit me from investing on Yieldstreet if my portfolio total was less than $40,000.

If your portfolio is large enough, however, this fund is easily one of my favorite ways to invest in alternatives.

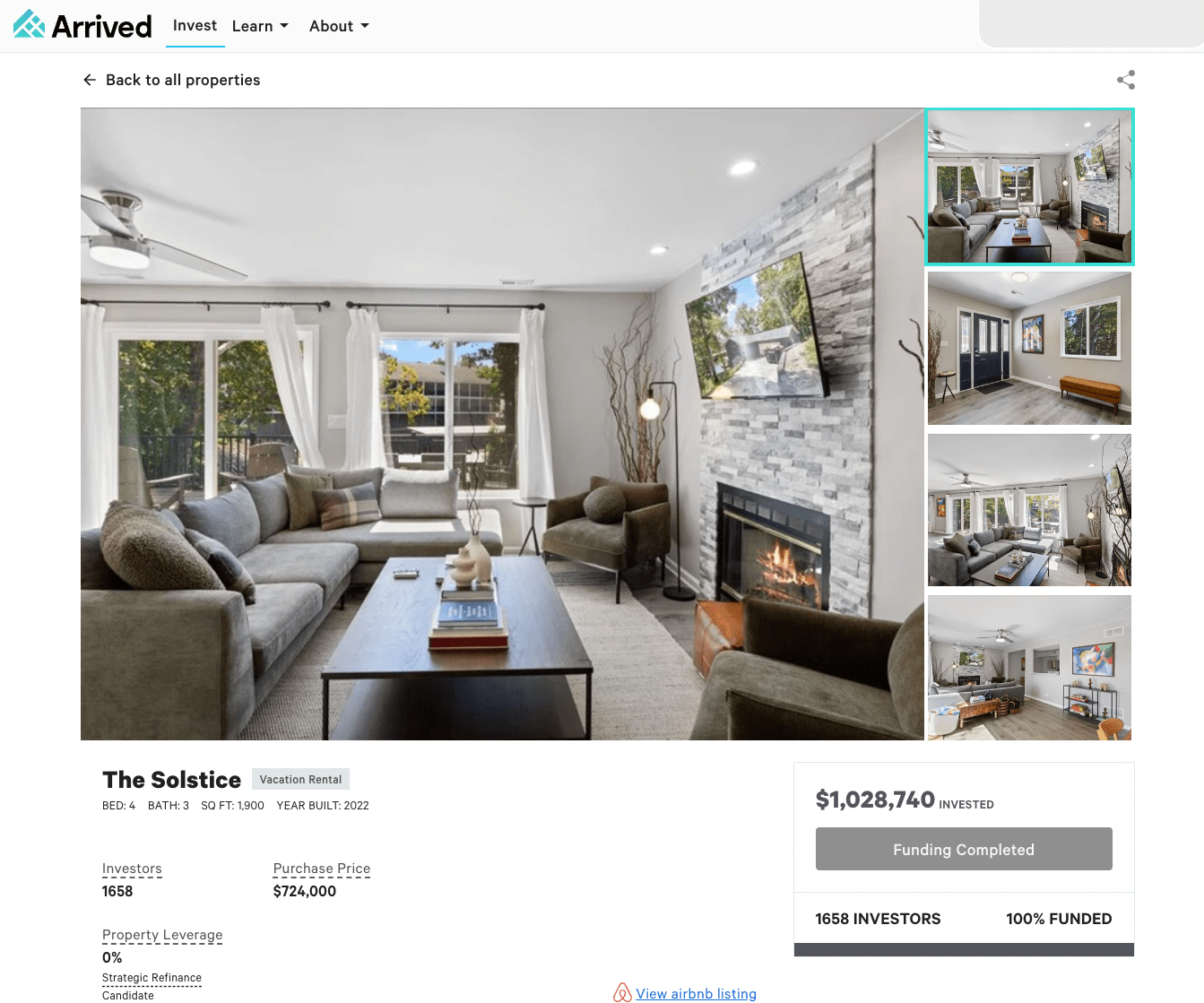

2. Arrived: best for vacation properties

- Overall rating:

- Asset(s): Single-family homes

- Minimum investment: $100

Arrived is the easiest way to start investing in real estate.

You can sign up in a few minutes, browse through Arrived's investment properties, choose between long- or short-term rentals, and invest with just $100.

Here's how Arrived works:

- The investment team analyzes thousands of deals, approving fewer than 0.2%.

- After passing the due diligence, Arrived will make an offer and buy a property.

- After purchasing a new property, the company “securitizes” it with the SEC, which allows users to buy individual shares.

- You purchase shares and have direct ownership in the LLC that owns the property.

- Arrived lists and rents the property, then distributes the rental income as dividends.

- After a 5–7 year holding period (on average), Arrived may sell the property and distribute the proceeds from any price appreciation.

The entire process is very straightforward and easy to complete from Arrived's website or mobile app.

To date, Arrived has distributed more than $4.5 million in dividends (rental income). And all investors had to do was register, buy shares, and wait.

3. Fundrise: best for venture capital

- Overall rating:

- Asset(s): Venture capital fund and real estate

- Minimum investment: $10

Fundrise is another one of the top real estate crowdfunding platforms for non-accredited investors.

Like Arrived, Fundrise is easy to use and offers a simple way to start investing in real estate.

But unlike Arrived, Fundrise invests in multi-family buildings, industrial properties, and residential homes. Its current real estate portfolio is worth over $7 billion.

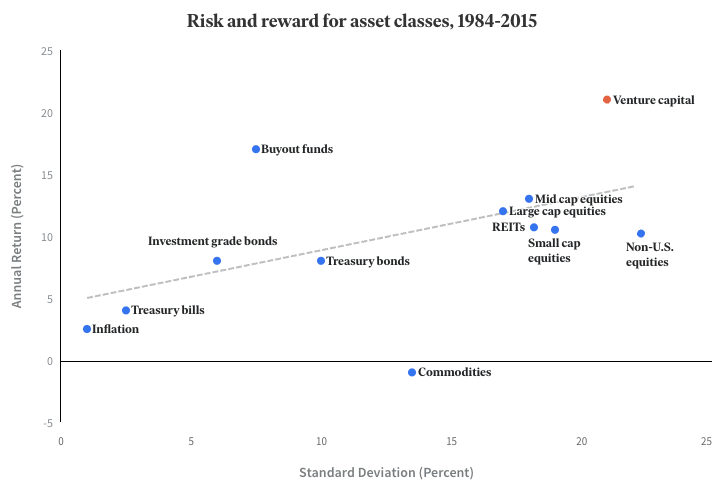

While it's best known for its real estate arm, I want to highlight a different investment opportunity that Fundrise offers: venture capital (VC).

Like real estate, VC has long been almost entirely inaccessible to individual investors. And it has been one of the best-performing asset classes over the last 30+ years:

Source: Fundrise

As it did with real estate, Fundrise is making the world of venture capital available to non-accredited investors with the Fundrise Innovation Fund.

The Innovation Fund invests in private technology companies with large growth potential. It invests in both equity deals and private corporate bonds.

A few of its most recent investments include Databricks and Canva. This is the best way for non-accredited investors to invest in tech startups.

4. Masterworks: best for high-end art

- Overall rating:

- Asset(s): Art

- Minimum investment: $15,000

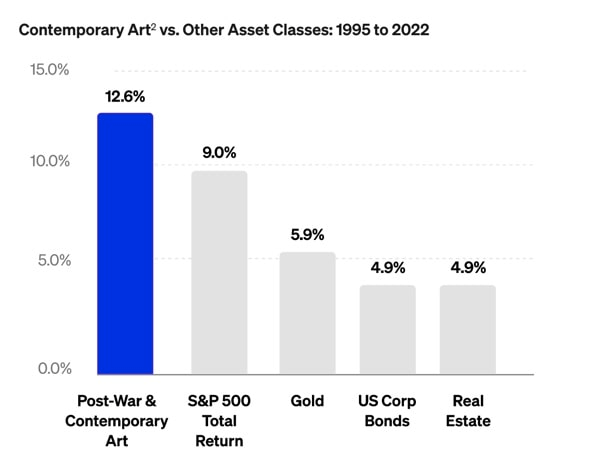

Masterworks is the best platform for investing in high-end, contemporary art, an asset class that has performed well over the last 25+ years:

Source: Masterworks

The process of investing on Masterworks resembles Arrived's process:

- The platform's team of experts analyzes thousands of artists and paintings, looking for the ones with the most momentum.

- The team purchases, ships, and stores the artwork.

- The company securitizes the artwork with the SEC, allowing you to buy individual shares.

- If your art appreciates and you want to realize returns, you can sell your shares to other Masterworks investors or wait until the team sells the painting for your proceeds to be distributed.

If you're interested in investing in art on Masterworks but don't have $15,000, you can get special approval to invest smaller amounts (like $5,000–$10,000). It's worth making the introductory call.

5. Public: best for cryptocurrencies, collectibles, and traditional markets

- Overall rating:

- Asset(s): Cryptocurrencies, collectibles, stocks, bonds, and Treasuries

- Minimum investment: $0

Public is our most recommended brokerage.

It has an excellent design, is fast, and offers free stock and ETF trading. Additionally, you can invest in Treasury bonds.

For alternatives, Public offers access to several of the most popular cryptocurrencies and a number of collectibles, including art, trading cards, shoes, handbags, and NFTs:

Source: Public

If you have an affinity for a category of collectibles and there's a market for it, it may be worth exploring as a potential investment opportunity.

Plus, you can invest in these alternatives right alongside your traditional investments in stocks, ETFs, and bonds (which should probably make up the bulk of your investment portfolio).

6. RealtyMogul: best for private REITs

- Overall rating:

- Asset(s): Private real estate investment trusts (REITs)

- Minimum investment: $5,000

RealtyMogul is another real estate crowdfunding platform with investments available to non-accredited investors — private REITs.

A real estate investment trust (REIT) is a single investment into a diversified basket of real estate properties.

To qualify as a REIT, however, the trust must distribute 90% or more of all taxable income to its investors each year. This makes them an attractive investment for income-seeking investors.

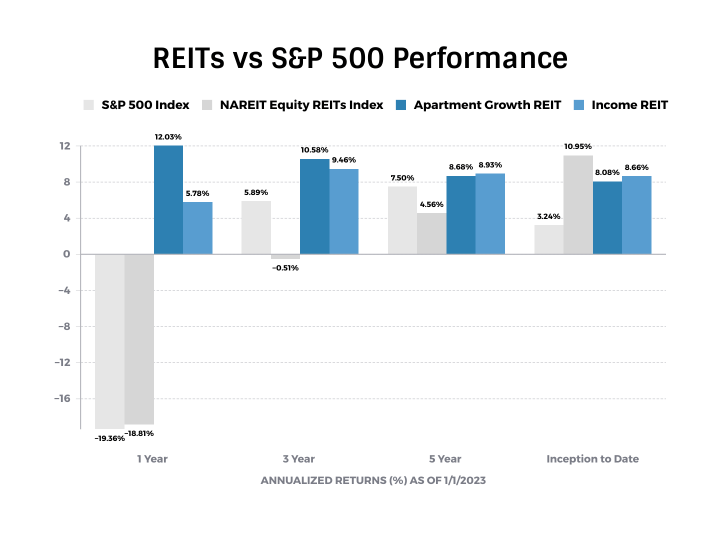

In addition to paying high dividends, REITs are also known for their moderate long-term capital appreciation. In this area, RealtyMogul's Growth REIT and Income REIT have done well:

Source: RealtyMogul

As their names suggest, the Growth REIT is more focused on value-add projects (to aim for increased price appreciation) while the Income REIT is more focused on stability and dividends.

7. Prosper: best for peer-to-peer lending

- Overall rating:

- Asset(s): Peer-to-peer lending

- Minimum investment: $25

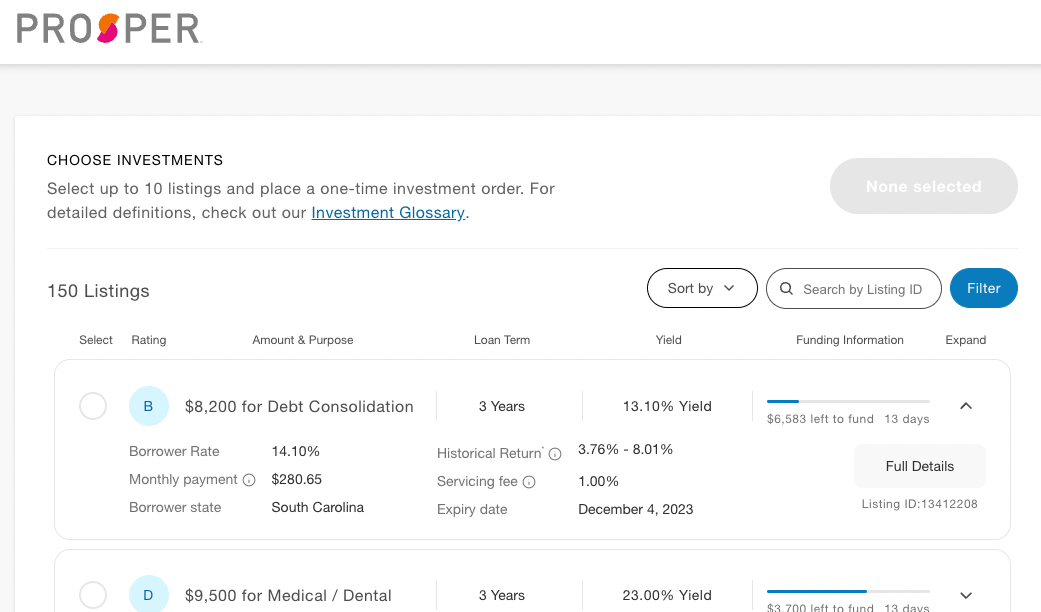

Prosper is a peer-to-peer (P2P) lending platform that allows you to lend other people money for a variety of uses, including debt consolidation, medical expenses, home improvement projects, weddings, and more.

Each listing has a credit rating, loan term, target yield, and details about the borrower:

Source: Prosper

Since 2005, more than $25 billion has been invested on Prosper.

Like RealtyMogul, investors are drawn to P2P lending for monthly cash flow. Over the last 18 years, the average annualized return on Prosper has been 5.7%.

On Prosper, you can invest in individual loans or use Auto Invest, which will deploy your money in a pre-set mix. When using Auto Invest, your money is automatically reinvested in new loans, so it is always working for you.

What is an accredited investor?

To protect investors from assets considered especially risky, the Securities and Exchange Commission (SEC) only allows “accredited investors” to own certain types of investments.

There is no certification to become an accredited investor. To be considered an accredited investor, you must meet one of the following criteria:

- Have an annual individual income of $200,000+ or joint income of $300,000+ for each of the last two years and be on pace for at least that much income this year.

- Have a net worth of at least $1 million, excluding your primary residence.

- Qualify as an investment professional via a Series 7, 65, or 82 license.

If you meet one of these three criteria, you qualify as an accredited investor.

To start investing on an accredited investor platform, you will need to create an account and have your status verified with the platform's customer support team.

What can a non-accredited investor invest in?

While it might seem like all of the new alternative investing platforms are for accredited investors only, most of these platforms have opportunities for non-accredited (retail) investors as well.

In fact, even as a retail investor, there's a way to invest in almost every private market.

Here's a recap of a few different asset types and where you can invest in them:

- Multi-asset fund: Yieldstreet

- Real estate: Arrived, Fundrise, RealtyMogul

- Venture capital: Fundrise

- Art: Masterworks

- Collectibles: Public

- P2P lending: Prosper

However, keep in mind that the majority of your investment portfolio (75% or more) should probably be invested in traditional, public market assets like stocks, bonds, ETFs, and Treasuries.

If you don't already have a traditional brokerage account, we recommend Public as a good option for beginners.

How we chose the best platforms

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good is the platform itself?

- Price/fees: Overall price, value for money, and any hidden fees.

- Usability: What the interface looks like, whether the platform is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of site information as well as company and brand reputation.

- Audience: Who the platform is for and whether it actually works.

- Offers: Whether there is a special offer for signing up or any discounts.

.png)